28+ self employed mortgage loan

Find A Lender That Offers Great Service. Web With FHA loans you may be able to qualify for a higher DTI up to 50 with the manual underwriting process.

Mortgage Broker Geebung Aspley John Meade Mortgage Choice

For many borrowers that isnt a practical solution.

. Web Provide thorough financial records. Any borrower needs to provide extensive documentation of income. Fast Easy Approval.

Web Down payment size. Purchase Refi Options. Web Some of the documents required to apply for a mortgage loans being self employed are the following.

Web To decide whether you qualify for a self-employed mortgage a lender will consider your net income your gross income minus the costs you incur for doing. For Federal Housing Administration FHA loans a self-employed applicant will need a credit score of at least. Web This can make it more difficult to prove steady income which can impact your chances of being approved for a mortgage.

Comparisons Trusted Low Interest Rates. Compare More Than Just Rates. Web For some loans including a conventional home loan for self-employed individuals lenders usually require a minimum credit score of 620 unless a large down.

Web Self-employed mortgage loan options. Web Mortgage Loan- HDFC Loan against property enables mortgaging of residential and commercial properties at attractive rates for quick funds. Visit now to know more 91.

Secure a home mortgage using 12 to 24 months of bank statements. We offer no doc loans no employment and no. Home loans for self-employed borrowers no paystubs or tax returns needed.

Well Help You Estimate Your Monthly Payment. Purchase or Cash-Out Refinance Loans. USDA and VA loans wont require a down payment but conventional and FHA loans do.

This is especially important when you apply for mortgages for. LawDepot Has You Covered with a Wide Variety of Legal Documents. Web Why can it be difficult to get a self employed mortgage.

Whether youre a first time buyer or switching your mortgage. Less Paperwork and Hassles. If you apply for a.

Additional reasons why self-employment may make it. Web In some cases even with 30 down the self-employed borrower will be required to pay PMI. Web Traditionally self-employed borrowers have a tougher time qualifying for a loan than a traditional borrower who receives a W-2 from their employer.

Secure a home mortgage using 12 to 24 months of bank statements. Current bail insurance statement the policy must be at least. Web Loan Officer Kevin OConnor has over 17 years of experience as a Mortgage Loan Originator and is a trusted resource for mortgage education and information.

Compare Home Financing Options Online Get Quotes. Purchase Refi Options. Do Self-Employed Home Loan Borrowers Have.

Web 18 hours agoSelf-employed borrowers often take advantage of various tax deductions including business expenses to lower their taxable income and make it easier to qualify. Home loans for self-employed borrowers no paystubs or tax returns needed. Best Personal Loan Company Reviews of 2023.

We Use Bank Statement to Qualify. Web Fortunately self-employed borrowers are eligible for virtually all of the same mortgage types available to others. Web Getting a mortgage is best not left to spur of the moment especially if youre self-employed so its a good idea to get pre-qualified for your loan.

The good news is. Purchase or Cash-Out Refinance Loans. That means you can qualify for a conventional loan.

Web Self-employed mortgage borrowers can qualify for conventional and government-backed loans. Its possible to buy with as little as 3 down or 35. Web The biggest difference is the documentation your lender may require in support of your mortgage application.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. The Best Offers from BBB A Accredited Companies for self employed. Step-by-Step Instructions on How to Complete Your Mortgage Agreement Today.

Youre more likely to get approved and have favorable loan. Self-employed or seasonal wage earners. Less Paperwork and Hassles.

We Use Bank Statement to Qualify. The payment rates on this housing loan. Just like any other home buyer self-employed buyers have four main options for a home loan.

Need To Know How Much You Can Afford. Web In 2021 this loan amount limit ranged from 548250 to 822375.

Mortgages For Self Employed Borrowers An In Depth Guide Mfm Bankers

Mortgage Guide For The Self Employed Moneygeek Com

Self Employed Home Loans Explained Assurance Financial

How To Get A Mortgage When You Re Self Employed Money Empire New Zealand

How To Get A Mortgage When You Are Self Employed

How To Get A Mortgage If You Re Newly Self Employed

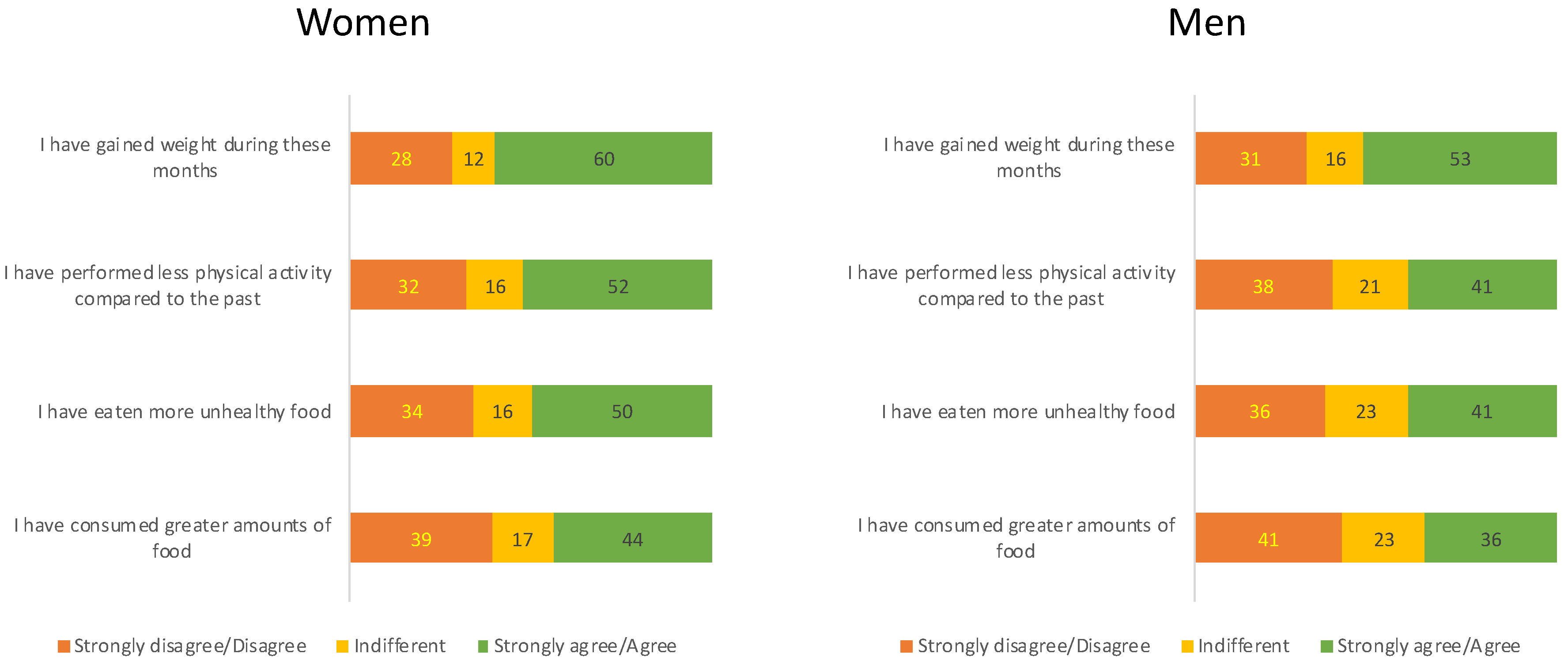

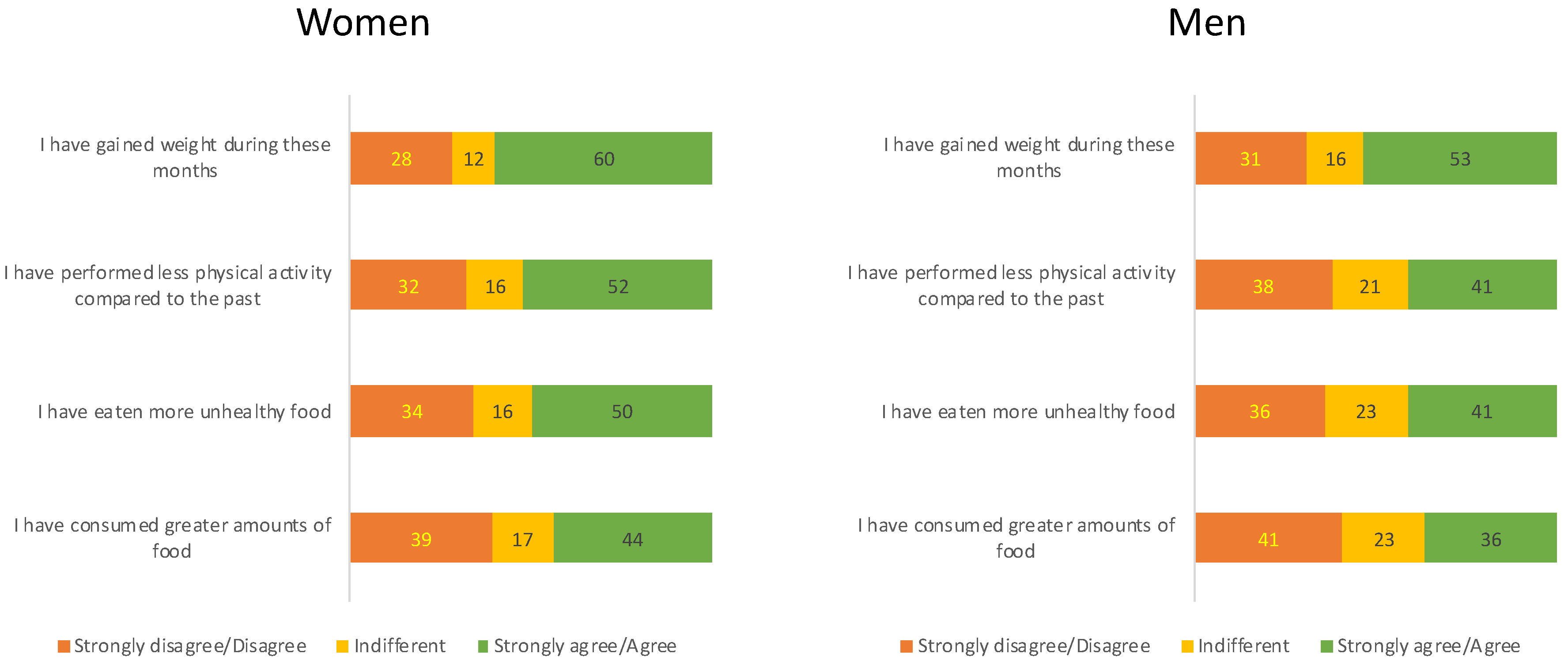

Sustainability Free Full Text Factors Associated With Perceived Change In Weight Physical Activity And Food Consumption During The Covid 19 Lockdown In Latin America

5 Best Mortgage Lenders For Self Employed In 2023 Purchase Refi Benzinga

Best Self Employed Mortgage Products Enness

Connie Coe Owner Self Employed Linkedin

How To Get A Mortgage When Self Employed

Self Employed Home Loans Explained Assurance Financial

Home Loans Business Lending Switch Finance Mortgage Brokers Gold Coast

Self Employed Home Loans Explained Assurance Financial

Pdf The Hitrap Facility For Slow Highly Charged Ions

How To Get A Self Employed Mortgage Lendingtree

Self Employed Mortgage Options Get Your Loan Approved